Kutools for Excel provides a fix for both of these issues and more.

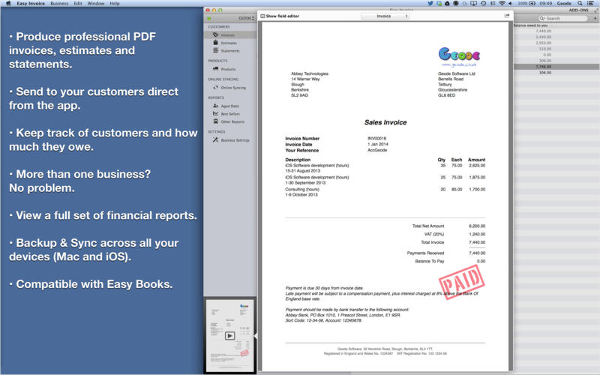

The first method covered is designed for only one spreadsheet or workbook and have the unfortunate possibility of overlap when you forget to save. Those of you who need a way to generate invoice numbers for multiple workbooks will find those needs met in the use of Kutools. Method 2: Add Invoice Number Using Kutools For Excel Just be sure to save the workbook prior to closing it out every time or the work will be lost.

Automatic invoice generator generator#

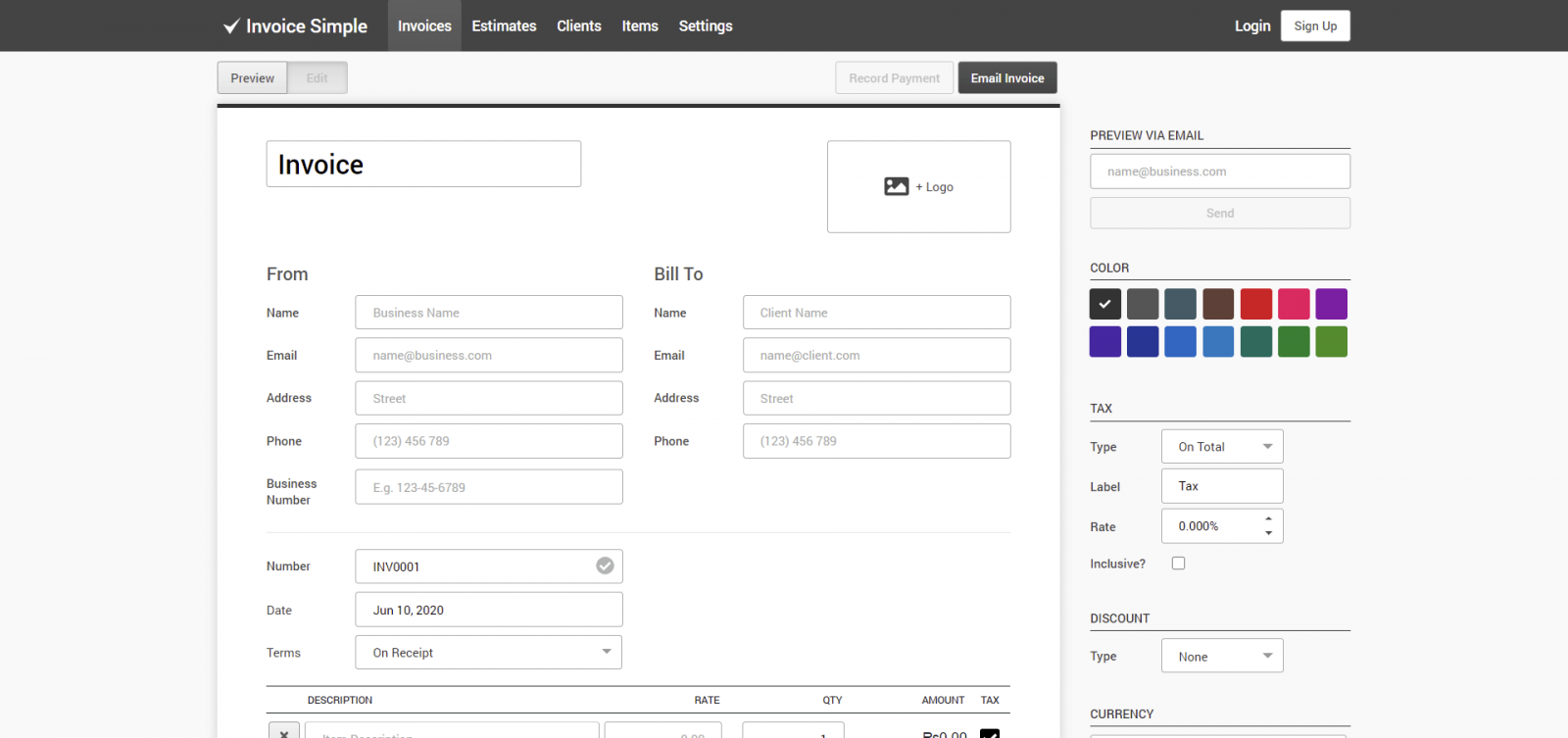

Choose where it will be saved and then just hit the Save button.Įach an every time you open up the Invoice Number Generator workbook, the invoice number will be one number greater than the last time. Enter the name of the workbook and make sure the Save As Type box is set to Excel Macro-Enabled Workbook (*.xlsm). To do so, click File and then Save (or Save As if filing new or under a different name). Once you are finished, make sure to Save the current workbook. Once the formula has been edited to fit your needs, you can copy and paste it into the cell and press enter to receive the invoice number. This is not the same cell you have the beginning invoice number in but the specified cell for the results. You’ll want to place the formula into a cell for the automatic invoice generation. The “CompanyName” is reserved for the text you want to be displayed in your invoice numbers. Remember that the C3 in the formula is the cell in which you’ve placed the beginning invoice number. =”CompanyName”&TEXT(NOW(),”MMDDHHMMSS”)& C3 They can be a bit difficult to remember offhand but you can always save them as an Autotext entry if you need to use them again later at any time. This is what your customer is required to pay you.The following formulas below will enable you to verify your invoice numbers. Total: The total displays the balance due which is calculated from the amount of each line item on the invoice.Notes: Within the notes section of the invoice, you can stipulate any additional terms of service that you've agreed to with your customer.So please consult your local tax resource to determine how much tax you should be applying to your invoices. This rate may differ depending on the geographic location you're business operates in. Tax: Indicating the tax rate applied to the cost of the goods or services provided is legally required on invoices.The line items also require a quantity so the customer knows how many goods or services they are being billed for, the price of the line item and tax rate applied to it, and the amount the line item costs. Line Item: Each line item on an invoice should have a name for the goods or services provided, along with a description of those goods and services.And, since invoices are often due in a specified number of days after receival, the invoice date is important in showcasing when payment is due. Invoice Date: The invoice date indicates when an invoice has been issued which helps your customers if they are receiving multiple invoices from you.Invoice numbers can be formatted in different ways such as file numbers, billing codes or date-based purchase order numbers. Invoice Number: Every invoice has a unique identifier in the form of an invoice number, which helps you keep track of multiple invoices.Bill to: Your customer's business name and address will be displayed within this section, as it indicates who is being invoiced for the receival of goods or services.Your Company Name & Address: The name and address of your company is usually displayed at the top of your invoice in order to differentiate between the company that is providing the goods and services and the company that is receiving them.Description: A description aides in helping your customer understand the nature of the goods and services being invoiced for.This is helpful for when tax time rolls around and for keeping accurate records of your invoices.

Title: A title is a critical element of an invoice because it allows you, and your client, to differentiate between invoices.There are 10 elements of an invoice that you should be aware of, some of which are necessary while others can be used for customization.

0 kommentar(er)

0 kommentar(er)